NY DOS-0999-f 2016-2025 free printable template

Show details

You may also pay by MasterCard or Visa using the appropriate credit card authorization form. REQUESTS RECEIVED WITHOUT PAYMENT WILL BE RETURNED DOS-0999-f Rev.01/16. New York State Department of State Division of Licensing Services P. O. Box 22001 Albany NY 12201-2001 Customer Service 518 474-4429 www. dos. ny. gov Request for Certification/Certified Copies of Records PLEASE FILL IN ALL OF THE INFORMATION REQUESTED Your Name Your Phone Number Your Current Address Mail Certification To Check...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dos 0999 form

Edit your new york certification certified records form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dos 0999 f form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ny request certification form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dos 0999 state form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DOS-0999-f Form Versions

Version

Form Popularity

Fillable & printabley

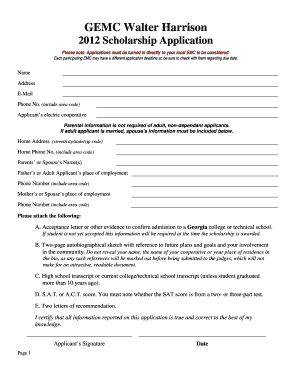

How to fill out ny dos 0999 f form

How to fill out NY DOS-0999-f

01

Obtain the NY DOS-0999-f form from the New York State Department of State website or local office.

02

Fill in the applicant's name and address at the top of the form.

03

Complete the section that asks for the type of business entity.

04

Provide the date of formation or registration of the business.

05

Indicate the reason for filing the form.

06

Review the information for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the form by mailing it to the appropriate address or in-person to the local office.

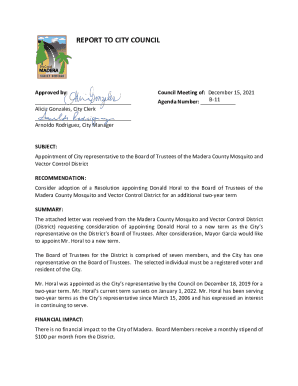

Who needs NY DOS-0999-f?

01

Businesses registered in New York that need to amend information.

02

Entities seeking to dissolve or withdraw their business registration.

03

Businesses applying for certain permits or licenses requiring this form.

Fill

0999 pdf

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my descriptive document directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form forms and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify forms dos without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your new york request certification certified copies into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete dos document online?

pdfFiller makes it easy to finish and sign form just online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

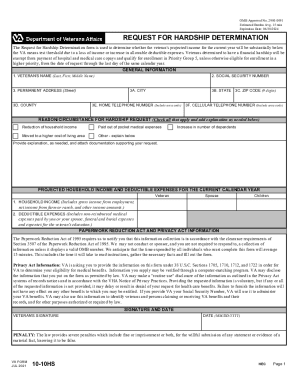

What is NY DOS-0999-f?

NY DOS-0999-f is a form used by the New York State Department of State for certain business-related filings, including the reporting of specific information about a corporation or business entity.

Who is required to file NY DOS-0999-f?

Business entities operating in New York State, including corporations, limited liability companies (LLCs), and other organizations, may be required to file NY DOS-0999-f depending on their specific circumstances, such as changes to their information or compliance requirements.

How to fill out NY DOS-0999-f?

To fill out NY DOS-0999-f, you should provide accurate details regarding the business entity, including names, addresses, and any changes in the information previously submitted. Make sure to follow the instructions provided with the form for accurate completion.

What is the purpose of NY DOS-0999-f?

The purpose of NY DOS-0999-f is to maintain up-to-date records of business entities registered in New York State, ensuring compliance with state regulations and allowing the state to keep track of business operations.

What information must be reported on NY DOS-0999-f?

The information that must be reported on NY DOS-0999-f typically includes the business name, address, registered agent information, and any changes in the structure or operations of the business since the last filing.

Fill out your NY DOS-0999-f online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

0999 F Fill is not the form you're looking for?Search for another form here.

Keywords relevant to form type forms

Related to form type

If you believe that this page should be taken down, please follow our DMCA take down process

here

.